Against the backdrop of a modest recovery in Europe’s steel tube sector, EN 10216-5 stainless steel tubing—particularly grades like 1.4404 (316L)—has emerged as a growth driver, fueled by surging demand from chemical processing, marine engineering, and renewable energy industries. According to EUROFER’s Q3 2025 report, European standard stainless steel tube shipments are projected to rise 3.2% year-on-year, outpacing the overall sector’s 0.9% growth forecast .

EN 10216-5: The Benchmark for Corrosion Resistance

The EN 10216-5 standard, which governs seamless stainless steel tubes for pressure purposes, has become the gold standard for high-corrosion environments. Leading manufacturers like thyssenkrupp Materials Trading now offer EN 10216-5 compliant 1.4404 stainless steel pipes with outer diameters ranging from 4.0mm to 406.4mm and wall thicknesses up to 40.49mm, catering to diverse industrial needs . These tubes integrate 16-18% chromium, 10-14% nickel, and 2-3% molybdenum—elements that enable resistance to chloride-induced pitting, a critical requirement for coastal and chemical facilities .

Lemu Müller, a Danish industrial supplier, reports a 45% spike in inquiries for EN 10216-5 1.4541 and 1.4404 tubes in 2025, with delivery lead times stabilizing at 5 working days for standard sizes, indicating robust supply chain readiness . “Clients are no longer choosing generic stainless steel—they’re specifying EN 10216-5 compliance to avoid downtime from corrosion failures,” notes Lars Hansen, the company’s product manager.

1.4404/316L Tubes: Dominating High-Growth Sectors

1.4404 stainless steel pipes, widely known as 316L seamless stainless tubes, are leading the demand surge. In the Middle East, Dubai’s newest seawater desalination plant has installed 2,500 tons of Φ325×12mm EN 10216-5 1.4404 tubing, leveraging its 3-5x longer service life compared to 304 stainless steel . Meanwhile, European chemical giants like BASF are retrofitting aging facilities with corrosion-resistant stainless steel pipes, with EN 10216-5 grades accounting for 72% of their 2025 pipe orders .

The renewable energy sector is another key driver. Offshore wind farms in the North Sea require tubes that withstand salt spray and extreme pressures; Jiangsu Jinwei Stainless Steel, a major exporter, has shipped 10,000 tons of EN 10216-5 1.4404 tubing to German wind projects this year, certified by SGS for corrosion resistance . “European buyers prioritize EN 10216-5 compliance over cost, as it aligns with the EU’s ‘Green Deal’ durability requirements,” explains Zhang Wei, the company’s export director.

Market Outlook: Standards as a Competitive Edge

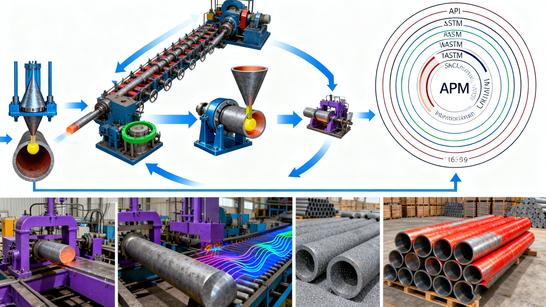

While the EU tube market faces structural headwinds, EUROFER emphasizes that high-value segments like corrosion-resistant seamless tubes will drive recovery . Manufacturers are responding by expanding production capacity: thyssenkrupp recently upgraded its Duisburg plant to double output of EN 10216-5 1.4404 and 1.4571 tubes , while Chinese suppliers like Zhangjiagang Chewit International are securing ISO 9001 and TS 16949 certifications to penetrate European markets .

“EN 10216-5 isn’t just a standard—it’s a market access ticket,” says Maria Lopez, a steel industry analyst at Kallanish. “As industries prioritize longevity and sustainability, 1.4404 and 316L seamless stainless tubes will remain indispensable.”

Sources: