Global Seamless Steel Pipe Market Deep Analysis Report: Trends, Opportunities, and Technological Frontiers (2025-2035)

Chapter I: Executive Summary and Strategic Outlook

1.1 Market Size, Growth Forecast, and Key Differentiation Analysis

The global seamless steel pipe market is experiencing a structural growth cycle. In 2024, the market was valued at approximately USD 263.90 billion.1 Analysts forecast that the market will grow steadily at a Compound Annual Growth Rate (CAGR) of 5.5% during the forecast period from 2025 to 2032, expected to reach nearly USD 405.00 billion by 2032.1 The scope of the seamless pipe market is broad, covering two main types: hot-finished seamless pipes and cold-finished seamless pipes, and includes various materials such as steel and its alloys, copper alloys, and nickel alloys.1

It is important to note that different research firms may present varying market size valuations. For instance, some reports set the 2025 baseline value at USD 69.9 billion and forecast a higher CAGR of 7.0% from 2025 to 2035.2 This discrepancy typically arises from differences in defining the market scope. Given the significant demand for high-value materials like nickel and copper alloys in technologically demanding sectors such as Oil & Gas (O&G), aerospace, and specialty chemicals 1, adopting the broader market valuation (baseline of USD 263.90 billion) provides a more accurate reflection of the total demand value and technology premium in the high-end seamless pipe market. Therefore, utilizing the high-value model for strategic planning aids companies in guiding investment decisions towards high-value-added markets.

1.2 Core Drivers and Long-Term Structural Support

The growth of the seamless steel pipe market is primarily driven by two structural demands: global energy infrastructure investment and industrialization in the Asia Pacific region.

Firstly, the Oil & Gas sector is the dominant driver of the seamless pipe market, with approximately 5% of global seamless pipe demand originating from pipeline expansion and exploration projects.3 In regions like North America, consumption is highly concentrated in high-end, pressure-bearing applications, with energy and oilfield applications accounting for about 60% of domestic demand.3

Secondly, the rapid industrialization and large-scale infrastructure projects in the Asia Pacific (APAC) region constitute the largest global volume driver.1 Industrialization and infrastructural development in this region, including increased transportation and energy consumption, drive significant general demand for seamless pipes.1

Finally, technological advancements are another critical driver. To meet compliance requirements for deep-well drilling and high-pressure pipeline projects, the industry trend is inevitably towards adopting high-strength, corrosion-resistant alloy grades such as X70/X80 high-yield strength steel, duplex steel, and nickel alloys.3

1.3 Strategic Guidance for Manufacturers

Facing increasingly rigorous global market demands for quality and safety, leading manufacturers must shift their strategic focus towards technological upgrades and premium market certification. It is recommended that companies concentrate R&D efforts and capacity upgrades on producing high-yield strength pipe materials compliant with American Petroleum Institute (API) Specification 5L Product Specification Level 2 (PSL2) and International Organization for Standardization (ISO) 3183 standards.4 Simultaneously, investing in automated production lines and technologies like Non-Destructive Testing (NDT) is crucial for enhancing product quality consistency and meeting the stringent requirements of high-profit markets such as North America.4

Chapter II: Global Market Overview and Forecast Model Analysis (2025-2035)

2.1 Seamless Pipe Segmentation by Type and Manufacturing Path

The production and application of seamless steel pipes are primarily segmented based on processing temperature and process precision.

By product form, the market is mainly divided into Hot Finished Seamless Pipes and Cold Finished Seamless Pipes.1 Hot finished pipes are typically used for large-diameter, structural applications with relatively looser tolerance requirements. In contrast, cold finished pipes are widely utilized in scenarios demanding extremely high dimensional accuracy, such as precision instrumentation, hydraulic applications, and heat exchangers, due to their superior dimensional accuracy and surface quality.5

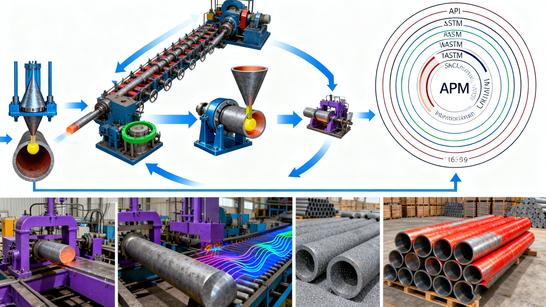

Major production processes include Continuous Mandrel Rolling and Multi-stand Plug Mill for high-volume and standard-size pipes, and Cross-roll Piercing & Pilger Rolling, often used for specific sizes and high-precision requirements.1

2.2 Market Size Comparison and CAGR Forecast for the Next Decade

Although market forecasts show a range of numerical differences, the global seamless steel pipe market is projected to maintain stable and robust growth over the next decade.

| Source | Market Baseline Value (2024/2025) | Forecast Period CAGR | End of Forecast Value | Primary Material Coverage |

|

Maximize Market Research 1 |

USD 263.90 Bn (2024) | 5.5% (2025-2032) | USD 405.00 Bn (2032) | Steel, Copper, Nickel, and Alloys |

|

Fact.MR 2 |

USD 69.9 Bn (2025E) | 7.0% (2025-2035) | USD 137.5 Bn (2035F) | (Likely limited to specific steel grades or applications) |

The table presents two distinct growth expectations. While the 5.5% CAGR is a conservative and stable projection for the broader alloy market, the higher 7.0% rate may indicate explosive growth in certain niche markets, especially high-value-added segments like cold-drawn precision pipes and high-strength alloy pipes. This suggests that market growth is increasingly concentrated in applications that are technologically intensive and demand strict adherence to dimensional tolerances and material performance.

2.3 Macro Energy Structure Support for Pipe Demand

The stable growth of global seamless steel pipe demand is largely underpinned by the structural support from the macro energy complex. Despite the global push for energy transition, data from the International Energy Agency (IEA) and the Organization of the Petroleum Exporting Countries (OPEC) clearly indicate that fossil fuels will remain a core component of the global energy mix for years to come.6

The IEA report shows that global oil demand growth is expected to accelerate, with total consumption rising to 104 million barrels per day in 2025 7, ensuring sustained demand for piping used in oil and gas pipelines and drilling activities. This structural demand translates into capital expenditure, with the International Energy Forum (IEF) highlighting the need for an additional $135 billion in global upstream oil and gas investment, reaching a total of $738 billion by 2030, to ensure adequate energy supply . This large-scale capital expenditure directly results in strong, structural procurement demand for API 5L-compliant line pipes, as well as Oil Country Tubular Goods (OCTG).

Chapter III: In-Depth Market Segmentation Analysis: Materials and End-Use Applications

3.1 Segmentation by Material: Surge in High-Strength Alloy Demand

In material segmentation, steel alloys maintain a dominant position with a 55.5% market share.3 However, the focus of market growth has shifted towards high-performance materials.

The current technological trend is towards high alloying, particularly emphasizing specialty materials such as duplex steel, nickel alloys, chromium-molybdenum steel, and stainless steel.4 These materials significantly mitigate the risk of failure in extreme environments like deep-well drilling, high-pressure boilers, and sour-gas processing by improving heat resistance, tensile strength, and chemical stability . For example, high-performance pipes can facilitate weight reduction and offer a longer fatigue life.4

This pursuit of high-alloy materials is a manifestation of technological advancement, raising both the performance limits of pipes and the technical barrier to market entry and product value-add. This explains the high consumption share of premium-grade applications in regions like North America.3 Demand for these advanced materials is experiencing robust growth from refineries, aerospace component manufacturers, and advanced machinery producers.4

3.2 Segmentation by End-Use Application: Focusing on High-Pressure and Precision Scenarios

Seamless steel pipes have broad application scenarios, but their core value is concentrated in areas demanding the highest levels of strength, corrosion resistance, and reliability.

3.2.1 Oil and Gas Industry

Oil & Gas (O&G) is the largest end-user, with seamless pipes primarily used in oilfield drilling activities, offshore platforms, and long-distance transmission pipelines.1 Due to the inherent strength, durability, and corrosion resistance of seamless pipes, a large number of pipeline projects are expected to be commissioned in the next five years.1 To ensure the operational safety and efficiency of deep-sea and cross-border pipelines, there is increasing demand for high-yield strength pipe grades (such as API 5L X70 and X80), necessitating extreme levels of material innovation.3

3.2.2 Automotive, Machinery, and Precision Industries

Cold-drawn seamless steel pipes hold an irreplaceable position in the automotive and mechanical sectors. They are mainly applied in hydraulic systems, heat exchangers, and precision instrumentation manufacturing where extremely tight tolerances are required .

3.2.3 Energy and Power Sector

In the energy and power sector, pressure-bearing seamless pipes are crucial for high-temperature and high-pressure environments. For instance, boiler tubes must comply with national standards like GB5310-2008 and steel grades such as ASTM A335 P11 and P12 to meet high strength and corrosion resistance requirements, offering vital support for national energy security.9

Chapter IV: Global Regional Market Deep Dive and Differentiated Strategy

Global seamless steel pipe production and consumption are concentrated in three major regions: Asia Pacific, Europe, and North America.3 Regional demand patterns vary significantly, requiring manufacturers to adopt differentiated market strategies.

4.1 Asia Pacific (APAC): Dual Drivers of Industrialization and Urbanization

The APAC region is the world's largest consumer market for seamless steel pipes, contributing 45% of total global consumption.3 However, in terms of value share, APAC's global share in 2025 is estimated to be approximately 29.0%.3 This disparity between volume and value share indicates that demand in this region is primarily driven by high-volume, mid-to-low-end products serving infrastructure and general manufacturing needs.

The market drivers here are rapid urbanization and massive infrastructure expansion projects, such as the addition of over 30 million square meters of new infrastructure construction area annually.3 Major contributors include China, India, and Japan. India, in particular, is projected to be a significant market growth point in the region due to accelerating infrastructure and construction investments.1

4.2 North America: Premium Applications and Infrastructure Refurbishment

North America holds approximately 24.4% of the global value share in the seamless pipe market.3 Notably, the region accounts for a high consumption share of 35.4% across premium-grade applications.3 The fact that North America's value share (24.4%) slightly exceeds its consumption volume share (20%) 3 strongly demonstrates that the region demands the highest technical requirements and quality standards, leading to a significantly higher Average Selling Price (ASP) than in other global regions.

The core drivers in the North American market are major pipeline development, shale gas exploration, and the refurbishment of aging energy infrastructure.3 Specifically, the region is undergoing renovation of its 2.6 million kilometer aging pipeline network, stimulating long-term structural demand for more advanced, longer-life seamless pipe materials that meet stringent safety standards.3 More than 60% of upcoming North American infrastructure projects utilize seamless stainless steel pipes to handle high pressures and corrosive media.3

4.3 Characteristics of the Europe, Middle East, and Africa Markets

The European market accounts for 25% of global consumption.3 The demand pattern here focuses on precision manufacturing and specialized pipe applications, aligning with high standards in technology and quality. The Middle East & Africa (MEA) market share is 10% 3, with demand heavily concentrated on petrochemical expansion and Oil & Gas projects.

Comparison of Key Regional Market Value Drivers and Technical Requirements

| Region | Value Share (2025E) | Core Driver Type | Technical Focus/Demand Standards | Strategic Positioning |

|

APAC 3 |

29.0% | Volume Driven: Infrastructure, Urbanization | Standard Carbon Steel, General API/ISO requirements | Economy of Scale, Cost Control |

|

North America 3 |

24.4% | Value Driven: O&G Premium Grade Apps, Refurbishment | API 5L PSL2, X70+, NACE, High Alloys | High Profit, Technology Leadership |

|

Europe 3 |

25% (Volume) | Specialty Manufacturing, Precision Engineering | Strict Tolerance, Customization, High Quality Consistency | Specialization, High Added Value |

Chapter V: Technological Innovation and Production Frontiers: Industry 4.0 Integration

5.1 Metallurgy and Advanced Alloy Iteration

Modern energy and chemical projects impose increasingly stringent performance requirements on pipes, especially regarding tensile strength, heat resistance, and resistance to sulfide stress cracking (SSC).11 Therefore, metallurgy and the research and development of advanced alloys have become core competitive focuses .

High-grade materials such as duplex steel, nickel alloys, and chromium-molybdenum steel enhance chemical stability through compositional optimization, meeting the demands of refineries, high-pressure boilers, and deep-sea oil extraction operations . For example, duplex stainless steel seamless pipes can achieve tensile strengths exceeding 750 MPa.4 International standards like API 5L Annex H (for sour service) and NACE TM0177 standard 4 impose strict regulations for harsh environments, directly driving the metallurgical industry toward high-alloy, long-life materials, establishing a technological barrier for entry into premium markets.

5.2 Automation, Digitalization, and Precision Manufacturing

The integration of Industry 4.0 technologies, such as automation and digital production, is not only a means to improve product quality but also an effective commercial countermeasure against market constraints (such as volatile raw material prices and high production energy costs 3). By improving quality consistency and reducing scrap, manufacturers can effectively hedge against cost pressures.

Leading producers are investing in CNC cold-drawing machines, advanced heat treatment capabilities, and automated inspection lines.4 Digital inspection tools, such as real-time wall-thickness control, ovality detection, and Non-Destructive Testing (NDT) systems, are widely adopted to ensure consistent pipe quality and achieve extremely low defect rates.4 This precision manufacturing capability enables manufacturers to meet customized demands for thin-wall tubing, multi-grade orders, and special sizes from high-precision industries like aerospace and automotive.4 For example, JFE Steel Corporation significantly boosts production speed and maintains consistent surface quality for small-diameter seamless tubes by utilizing "teachingless" robotic systems and automated handling lines at its Chita Works.4

Chapter VI: Regulatory Environment and Industry Standards: International Compliance Requirements

The seamless steel pipe industry is governed by a strict global standard system to ensure product safety under extreme operating conditions.

6.1 API Spec 5L: The Global Pass for Oil and Gas Pipelines

API Spec 5L is the critical specification developed by the American Petroleum Institute for seamless and welded steel pipes used in pipeline transportation systems in the petroleum and natural gas industries.15 The standard covers various grades, including B, X42, X52, X60, X65, and X70, with each grade specifying particular requirements for chemical composition, mechanical properties, and testing.15

The most significant API 5L classification is the Product Specification Level (PSL): PSL1 and PSL2.16 PSL2 grade imposes more rigorous manufacturing requirements on pipes, mandating that the steel must be killed and refined according to fine grain practice, and prohibits the existence of repair welds.16 Therefore, PSL2 is fundamental for high-pressure, high-strength long-distance pipeline applications. API 5L also differentiates grades by yield strength; for instance, Grade X42 has a minimum yield strength of 42,000 psi, while Grade X70 has 70,000 psi.15 High-yield strength pipes like X70 and X80 are essential for achieving high operational safety and efficiency in deep-sea and cross-border pipelines.3

6.2 ISO 3183 and Global Compliance

The international standard ISO 3183:2019 "Petroleum and natural gas industries — Steel pipe for pipeline transportation systems" is a crucial supplement to API Spec 5L.8 This document specifies manufacturing requirements for the two Product Specification Levels (PSL 1 and PSL 2) of seamless and welded steel pipes for use in pipeline transportation systems, ensuring the pipes' interoperability and acceptability in the global supply chain.8

6.3 Compliance Barriers for Extreme Environments

Entry into high-value, high-risk application markets, especially sour-gas (H2S) environments, requires meeting additional compliance standards. For example, standards like NACE TM0177 and NACE TM0284 are used to evaluate the pipes' resistance to Sulfide Stress Cracking (SSC) in H2S environments.4 These strict compliance requirements, including advanced metallurgy, heat treatment capabilities, and Non-Destructive Testing systems, collectively form the necessary technological barrier for entry into premium markets such as deep-sea and shale gas exploration.4

Chapter VII: Competitive Landscape, Key Players, and Strategic Deployment

7.1 Competitive Landscape and Analysis of Major Players

The global seamless steel pipe market is moderately concentrated, dominated by a few integrated steel producers and specialized pipe companies with global footprints and technological advantages. Major players include Tenaris S.A., Nippon Steel Corporation, JFE Steel Corporation, ArcelorMittal, and D.P. Jindal Group, among others . These companies focus on advanced metallurgical techniques, heat treatment capabilities, and automated drawing lines to achieve strict tolerances and defect-free inner surfaces.17

7.2 Competitive Focus: From Capacity to Technical Service

The competitive focus of the market has shifted. Industrial buyers prioritize reliability, tensile strength, and operational safety as key procurement parameters.3 Consequently, competition has moved beyond mere capacity and price to encompass the provision of high-value-added technical services and product portfolios.

Strategic priorities for manufacturers include offering a wide product portfolio that covers carbon steel, stainless steel, duplex steel, and nickel alloys with high heat resistance grades, as well as establishing long-term supply contracts with major oil and gas operators and Engineering, Procurement, and Construction (EPC) contractors.17

7.3 Drivers of Industry Concentration

The stringent API/ISO standards and the high capital investment required for automated equipment, including CNC cold-drawing machines and NDT systems, constitute significant capital barriers.4 This high technical and capital threshold effectively limits the entry of new competitors, concentrating competitive advantages in the hands of a few global producers capable of providing comprehensive certifications and high-tech products. This structural factor is expected to further enhance the industry concentration of the global seamless steel pipe market.

Chapter VIII: Summary and Conclusion

The global seamless steel pipe market is projected to maintain stable and technology-driven growth between 2025 and 2035. The core market drivers are the structural demand from global energy infrastructure, particularly the sustained investment in the Oil & Gas sector, and the massive volume demand generated by large-scale industrialization and urbanization in the Asia Pacific region.

Future market profitability will increasingly depend on technology and regional differentiation strategies. Manufacturers must recognize that premium markets like North America and Europe demand significantly higher standards for product quality, compliance, and material performance than general markets. Therefore, focusing R&D resources on high-strength alloys (such as Duplex, X70+) and Industry 4.0 automation technologies is key to securing competitiveness in the high-end market. Meeting stringent international standards like API 5L PSL2, ISO 3183, and NACE is not only a prerequisite for participating in deep-well drilling and long-distance pipeline projects but also a strategic choice for building competitive barriers and securing long-term, high-margin contracts.