I. Executive Summary

The global flanges market, a core component in the supply chains of energy, infrastructure, and heavy industry, is set for robust structural growth in the foreseeable future. This report provides a comprehensive, in-depth analysis of the global flanges market size, key driving forces, segmentation structure, and critical technological trends.

1.1 Core Market Indicators and Growth Outlook

The analysis of the global flanges market indicates a stable medium-to-high growth rate of approximately 6% over the next decade. The market valuation is projected to range from USD 5.53 billion 1 to USD 9.8 billion 2 in 2025. This variation in baseline valuation primarily reflects the differences in analytical methodologies regarding the scope of high-value, specialized flanges (e.g., those used in nuclear or aerospace applications). By 2035, the market size is expected to grow further to between USD 10.6 billion and USD 17.9 billion 2, maintaining a steady Compound Annual Growth Rate (CAGR) of 5.5% to 6.2% throughout the forecast period (2025–2035).1

Structurally, Weld Neck Flanges (WNF) dominate the type segment due to their unparalleled safety and reliability in high-pressure applications, expected to capture a significant 42.3% market share in 2025.1 Regarding materials, Carbon Steel remains the largest segment, driven by cost-effectiveness and mechanical strength, though high-performance composites are rapidly gaining market share in specific sectors.3 Regionally, the Asia Pacific (APAC) leads the global market with a 40.7% share, fueled by industrialization and massive infrastructure investments.1

1.2 Five Key Structural Drivers Shaping Market Development

-

Rigid Demand from Energy Infrastructure: Continuous capital expenditure in the oil, gas, and power sectors, particularly the recovery of global upstream oil and gas investments, is the core impetus for the long-term growth of the flanges market.3

-

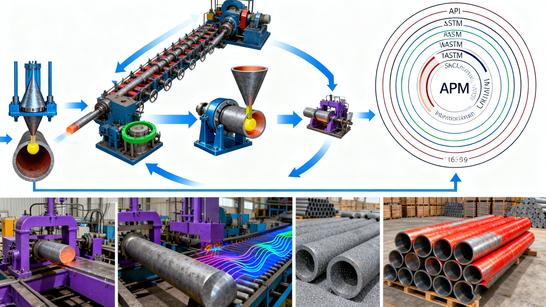

Compliance-Driven Manufacturing Upgrade: Stringent international and regional industry standards (such as the requirement for defect rates below 0.5% 3) are compelling manufacturers to adopt Industry 4.0 technologies like CNC machining, robotic welding, and digital inspection to achieve high precision and product consistency.6

-

Material Innovation for Optimized Total Cost of Ownership (TCO): Lightweight composite materials like Fiber Reinforced Polymers (FRPs) are significantly lighter—up to 60% lighter than traditional steel.4 This dramatically reduces transportation, installation, and maintenance costs, positioning FRPs as a preferred solution for end-users focused on TCO optimization.

-

Increased Competition in High-Pressure and High-Specification Products: Market competition is concentrated on the ability to meet extremely high-pressure classes (such as Class 1500, Class 2500) and adhere to rigorous international standards, including ASTM A105 8 and ISO 15590-3.9

-

Integration of Sustainability into the Supply Chain: Driven by growing environmental pressures, manufacturers are investing in eco-friendly materials and production processes to minimize their carbon footprint, aligning with global sustainable development initiatives.6

II. Market Size, Growth Drivers, and Macroeconomic Context

2.1 Global Flanges Market Size and CAGR Deep Analysis

The global flanges market is characterized by a stable structure and continuous growth. Market research data shows a high consensus on the growth rate for the forecast period (2025–2035), with the CAGR projected to stabilize between 5.5% and 6.2%.1

Data Integration and Discrepancy Interpretation

Despite the consistent growth rates, there is a variation in market valuation in the base year, with estimates for 2025 ranging from USD 5.53 billion 1 to USD 9.8 billion.2 Expert analysis suggests this valuation difference stems from the definition of the flange product category. Higher valuations typically include customized, high-value, and specialized flange components used in critical sectors like nuclear power, aerospace, and Arctic oil projects. The unit price for these high-specification flanges is significantly higher than for commodity-grade flanges, leading analysts focused on these high-value sub-markets to often derive a higher overall market valuation.

Resilience of the Growth Foundation

The growth foundation of the flanges market demonstrates significant resilience. Demand is not dependent on short-term economic cycles but is rooted in long-term infrastructure maintenance and expansion. Flange demand is directly related to the lifecycle of energy facilities, which often span decades. Global pipeline infrastructure investment exceeds USD 500 billion 3, and the replacement and maintenance of aging pipeline systems account for approximately 25% of the total market demand.3 This sustained investment in existing assets ensures stable demand for high-quality flanges, making the long-term certainty of market growth superior to the short-term impact of factors like raw material price volatility.

Table 1: Global Flanges Market Size Forecast Comparison and Core Driver Analysis (2025-2035)

| Market Metric | 2025 Valuation (USD Billion) | 2035 Forecast (USD Billion) | Forecast CAGR | Core Application Driver | Source |

| Forecast A (High) | 9.8 | 17.9 | 6.2% (2025-2035) | Petrochemical, Pipeline Construction | 2 |

| Forecast B (Mid) | 6.0 | 10.6 | 5.8% (2025-2035) | Basic Industry, Oil & Gas | 3 |

| Forecast C (Low) | 5.53 | 8.05 (2032F) | 5.5% (2025-2032) | Automotive, Water Management | 1 |

2.2 Core Growth Engine: Energy Infrastructure Investment and High-Pressure Demand

The oil and gas sector is the primary driver of the flanges market. According to reports, upstream oil and gas investment continues to increase to secure global energy supply, with total annual investment expected to rise by a further USD 26 billion in 2024, surpassing USD 600 billion for the first time in a decade.5 This sustained, large-scale capital expenditure directly translates into demand for flanges.

Pipeline Networks and High Safety Requirements

Flanges play a critical safety role in pipeline networks, ensuring connection points can withstand high-pressure fluid transfer (up to 5,000 psi or 6,000 psi).3 With the continuous expansion of global pipeline infrastructure, especially for natural gas transmission (gas consumption is expected to grow by over 20% by 2030 3), there is massive demand for high-pressure, high-reliability flange connections.

Expansion of the Power Sector

The rapidly growing power sector, including traditional thermal, heating power generation, and nuclear energy, requires flanges to ensure safe connections in high-temperature and high-pressure steam and cooling systems.4 The sustained focus on safety and efficiency drives demand for specialized high-pressure flanges like Weld Neck Flanges. Given the decades-long operational lifecycles of energy infrastructure projects, continuous global investment in flange demand is more deterministic than the impact of short-term raw material price fluctuations, thus guaranteeing the long-term certainty of the market.

2.3 Market Challenges, Restraints, and International Compliance Requirements

The main challenges faced by flange manufacturers include the volatility of raw material prices, such as carbon steel, which directly impacts manufacturing costs and profitability.4

Furthermore, flange manufacturers must comply with extremely strict international regulatory requirements and industry standards. In critical industries like oil and gas, nuclear power, and petrochemicals, regulations demand extremely high precision and quality to ensure system safety and reliability.4 For example, commonly adopted international standards include ASTM A105, which covers forged carbon steel flanges and piping components for ambient and higher-temperature service in pressure systems 8; and ISO 15590-3, which specifically addresses the specification for pipeline flanges.9 In Europe, manufacturers must also comply with regional regulations such as the Pressure Equipment Directive (PED).11

Strict testing and certification procedures pose a challenge for manufacturers and significantly increase operational costs. However, this high cost of compliance and the stringent limits on defect rates (e.g., the requirement for less than 0.5% 3) raise the entry barrier for the industry while providing a significant competitive advantage to existing market participants who are fully certified and possess robust quality control capabilities.

III. In-Depth Flanges Market Segmentation Analysis

3.1 Segmentation by Flange Type: Technical and Market Advantages of Weld Neck Flanges

The global flanges market is segmented by type into Weld Neck, Slip-on, Socket Weld, Blind, and others.1 Among all types, the Weld Neck Flange (WNF) dominates due to its structural advantages, projected to hold a 42.3% market share in 2025.1

The design feature of WNF involves a long, tapered hub that is welded to the pipe, reducing stress concentration at the connection point. This design offers superior strength and reliability, making it the sole choice for the most critical applications involving high pressure, high stress, and high or cryogenic temperatures.2 The high share of WNF reflects the current global infrastructure investment trend—a focus on high-value projects, such as upstream oil and gas and heavy-duty power generation facilities, that require the highest levels of safety and long-term operational reliability.

3.2 Segmentation by Material: Stability of Traditional Materials and Disruption by Composites

Cornerstone Position of Carbon Steel: Carbon steel is the largest material segment in the flanges market, with its market share estimated to be between 34.6% 1 and 57.3% 3 in 2025. Carbon steel maintains an irreplaceable position in basic industries and medium-to-low pressure applications due to its cost-effectiveness, ease of manufacture, and mechanical strength that meets ASTM and other standards requirements. Stainless steel, alloy steel, and nickel-based alloys are applied in specialized environments requiring extreme corrosion resistance, high temperature, or cryogenic resistance.12

The Revolution of Lightweight Composites: The flange industry is shifting towards the use of lightweight and corrosion-resistant composite materials, such as Fiber Reinforced Polymers (FRPs).4 FRP flanges are up to 60% lighter than their steel counterparts.4 This significant weight reduction advantage not only provides superior corrosion resistance but, more importantly, offers end-users optimization of operational costs and Total Cost of Ownership (TCO). Especially in large or remote projects, the cost savings in transportation, installation, and labor offered by FRP flanges are the primary drivers for their rapid market penetration.

3.3 Segmentation by End-User Industry: Re-evaluating Traditional Hierarchy

The flange demand segmentation is undergoing structural changes.

Oil, Gas, and Petrochemicals: This sector is the traditional market leader, commanding over 40% of the share in some specialized flange markets.13 The continuous reliance on natural gas (consumption expected to grow by over 20% by 2030 3) and upstream infrastructure investment secures this segment's core position.

The Significant Share of Automotive Manufacturing: It is worth analyzing the automotive manufacturing sector, which is projected to account for a 26.6% market share.1 This high proportion indicates that flange products have moved beyond traditional pipe connections to be widely used in high-precision components within automobiles, such as engines, exhaust systems, and turbochargers. The high demand in the automotive sector is characterized by the requirement for high-volume, extremely high-precision flanges. This necessitates that manufacturers possess advanced, highly automated manufacturing capabilities, such as reliance on CNC machining, which is technologically distinct from traditional heavy industry forging processes.

Power Generation and Water Management: Thermal and nuclear power plants account for approximately 18% to 20% of the total demand 3, providing a stable source of demand for high-pressure flanges. Furthermore, water management, HVAC, and the chemical industry are important application areas, with increasing demand for lightweight, corrosion-resistant composite flanges in these sectors.1

IV. Technological Advancements and Manufacturing Trends: Industry 4.0 and Sustainability

4.1 Manufacturing Automation and Digital Transformation

To meet increasingly stringent quality requirements and optimize production efficiency, flange manufacturing is actively embracing Industry 4.0 technologies.

The Popularity of High-Precision Manufacturing Technology: Computer Numerical Control (CNC) machining has become crucial for improving flange accuracy and ensuring geometric consistency.7 Simultaneously, robotic welding and automated assembly lines (especially for composite flanges) enable high-volume, high-quality production, helping to reduce unit manufacturing costs.4 The American Welding Society (AWS) reports that the adoption of robotic welding is rapidly increasing in the flange industry due to its capability to achieve consistent and high-quality welds on complex geometric components.4

The Intrinsic Link Between Technology and Compliance

Automation and digital transformation are not merely means to improve efficiency; they are necessary conditions for meeting strict industry standards. In critical applications like oil and gas and nuclear power, the requirement for extremely low defect rates (below 0.5% 3) makes traditional manual or semi-automated manufacturing methods unsustainable. The use of advanced robotics, artificial intelligence, and digital inspection techniques (such as ultrasonic testing 3) is fundamental for manufacturers to ensure product quality control, increase market responsiveness, and acquire high-value certifications.6

4.2 The Future of Smart Flanges and Sustainable Development

The Future of Smart Flanges: Smart flanges, integrated with Internet of Things (IoT) sensors, are a future trend. These intelligent components can provide real-time monitoring of critical operational parameters, thereby reducing the risk of leakage and supporting predictive maintenance, ultimately extending the operational lifespan of piping systems.7

The Pressure for Sustainable Manufacturing: Driven by global environmental concerns, flange manufacturers are under pressure to invest in environmentally friendly materials and production processes.6 This focus on sustainability encourages companies to optimize supply chains, reduce material waste 7, and promote recyclable materials and cleaner production processes to minimize their carbon footprint.

V. Regional Market Landscape and Strategic Focus

5.1 Asia Pacific (APAC): The Engine of Industrialization and Infrastructure Construction

The Asia Pacific region leads the global flanges market with a 40.7% share 1 due to its large-scale industrialization and infrastructure projects. Market expansion in this region is rapid, with a projected CAGR of 6.2%.1

The main drivers include the rapid expansion of the oil and gas and petrochemical industries in China, India, and Southeast Asia, the construction of new power generation capacity, and massive investment in urban water infrastructure. These factors collectively ensure a massive quantitative demand for various specifications of flanges in the APAC market.2

5.2 European Market: High Standards and Regulation-Driven Growth

The European market holds the second-largest global share (19.8%) 1 and is forecast to be one of the most dynamically growing regions (CAGR 5.3%).1

The European market is characterized by strict industrial standards and regulations. For instance, the Pressure Equipment Directive (PED) and REACH regulations require manufacturers to invest in high-quality flange solutions with traceability and environmental compliance.11 Growth in the European market is primarily concentrated in high-value, highly certified products used in pipeline safety initiatives and renewable energy projects.

Strategic Positioning: Value vs. Volume

Regional analysis indicates that market participants must adopt a dual strategy. The APAC market focuses on highly efficient mass production and cost control to meet huge quantitative demand, while the European and North American markets require manufacturers to concentrate on providing customized, high-specification, highly certified, value-added solutions. Manufacturers need to adjust their product portfolio and certification strategies across different regions.

VI. Conclusion, Competitive Landscape, and Strategic Recommendations

6.1 Overview of the Global Competitive Landscape

The global flanges market is highly fragmented and competitive. The competitive landscape is shifting from traditional cost competition towards differentiation based on technology and compliance. Successful market participants must possess the capabilities to: meet rigorous international standards and certification requirements, leverage automation technology to ensure product consistency, and establish stable supply chains to cope with raw material price volatility.6

Major competitors include global manufacturing giants such as Maass Global Group, AFG Holdings, Inc., and Pro-Flange.6 The fragmented nature of the market also provides opportunities for specialized manufacturers focusing on specific niche markets (such as high-pressure WNF or FRP composites).

6.2 Strategic Recommendations

Based on the in-depth analysis in this report, the following strategic recommendations are proposed for market participants:

-

Strategic Technology Investment: Focus investment on CNC machining and robotic welding to meet the high-precision, zero-defect requirements of the automotive and high-pressure WNF sectors. Treat these technologies as key assets for ensuring regulatory compliance and securing high-value orders.

-

Product Portfolio Innovation: Actively expand the share of high-performance composite flanges. Manufacturers should emphasize promoting the economic benefits of composites like FRPs in reducing customer TCO (transportation, installation, and maintenance).

-

Compliance Priority: Strategically view strict regulatory compliance (such as PED, ASTM standards) as a core competitive advantage and entry barrier. In high-value markets like Europe, certification level is key to unlocking profit.

-

Regional Market Differentiation: In the APAC region, pursue market share through economies of scale and efficient supply chains. In Europe and North America, focus on providing customized, high-certification solutions to achieve higher profit margins.